XPS launch Red Flag Index as the risk of pension scams increases

XPS launch Red Flag Index as the risk of pension scams increases

17 Sep 2020

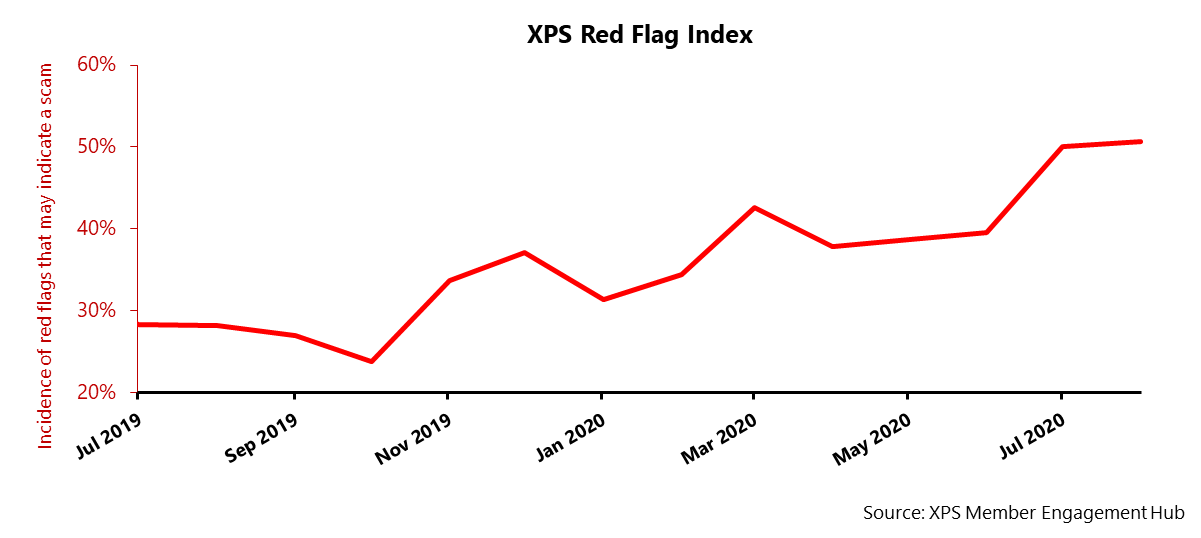

XPS is today launching a Red Flag Index as part of its monthly Transfer Watch tracker. The Index measures the incidence of possible scam red flags in cases covered by our scam protection service and will help give regular insights into activities that signal a threat to member outcomes.

The launch of the Index comes at a time when scams red flags are on the rise following lockdown, and the index saw a particular jump in red flags associated with fees and charges. Half of all transfers covered in the past two months have generated a red flag indicating possible scam activity.

Elsewhere, XPS’s Transfer Watch tracker revealed that defined benefit (DB) transfer values fell from July’s record-high to levels similar to pre-lockdown, whilst the number of members taking a transfer value also declined.

XPS Pensions Group’s Transfer Value Index fell consistently throughout the month from £260,700 at the end of July to £253,200 at the end of August. This was mainly a result of an increase in gilt yields during the month.

XPS Pensions Group’s Transfer Activity Index fell by around a third in August compared to July. Transfer Activity in August was at an annual equivalent of 0.67% of eligible members, down from 0.94% in July. This represents 67 in every 10,000 eligible members transferring each year.

In market news, an inquiry has been launched by the Work and Pensions Select Committee into the impact of the pension freedoms regulations since their introduction as part of the Pension Schemes Act in 2015. The first phase of this inquiry will focus on pension scams, which have increased in prevalence in the last 5 years.

Chart 1 – XPS Transfer Value and Transfer Activity Index

Chart 2 – XPS Red Flag Index

Nicola Young, Senior Consultant, XPS Pensions Group commented:

“The overall incidence of red flags has been increasing over time, with around 35% of cases since July 2019 identifying at least one warning sign. However, over the months since the COVID-19 pandemic we have seen this rise to around 50% of cases.

“The worrying spike in recent months is driven by a significant increase in members that have little to no understanding of fees in the arrangement they want to use to access their pension savings. This may be as a result of people urgently wanting to get at their savings due to current economic conditions.”

Mark Barlow, Partner, XPS Pensions Group commented:

“June and July saw our Transfer Value Index reach new record highs and so it isn’t surprising that transfer values have fallen back during August. This has been accompanied by a fall in transfer activity, which maybe a result of the usual summer lull or an indication of members struggling to find firms to advise on their transfer value.”

“We welcome the inquiry into the impact of pension freedoms. There have been many members who have benefited from the flexibilities introduced in 2015 but there have also been many victims of unscrupulous scammers who have sought to take advantage of the changes. That is why we are also launching our Red Flag Index which will form a new part of our Transfer Watch in future.”