20% fall in transfer activity but 49% indicated at least one red flag warning of a pension scam

20% fall in transfer activity but 49% indicated at least one red flag warning of a pension scam

19 Jan 2021

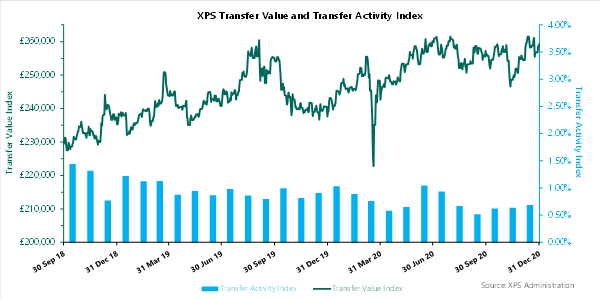

XPS Pension Group’s Transfer Watch saw substantial volatility in transfer values during 2020, particularly at the start of the pandemic. XPS’s Transfer Value Index finished the year at £259,000, 8% higher than it started. Despite this, the Transfer Activity Index saw a drop of 20% in members choosing to transfer during 2020 compared with 2019. This resulted in around 75 members transferring in every 1,000 eligible, down from 96 in the previous year.

XPS Pension Group’s Transfer Watch monitors how market developments have affected transfer values for a typical pension scheme member. It also monitors how many members are choosing to take a transfer from their DB pension scheme and, through its Red Flag index.

December 2020 marked a record high on the Red Flag Index, with 76% of transfers showing at least one warning sign of a potential scam. This represents a six-month continuous rise in the number of red flags seen and means that 49% of cases processed during 2020 showed at least one red flag, up from 34% last year.

Mark Barlow, Partner, XPS Pensions Group commented:

“Even though there has been significant turbulence along the way, transfer values finished 2020 higher than they started it. However, we have seen fewer people take the significant decision to transfer their pension during the year, perhaps put off by the current economic uncertainty. More concerning is the surge in pension scam red flags amongst those who have continued to transfer during the year.”

Helen Cavanagh, Consultant, XPS Pensions Group added:

“Over three-quarters of cases raised a red flag in December which is extremely worrying. This highlights that the risk of members falling victim to a pensions scam which reinforces the call from the Regulator for trustees and the industry to pledge to protect their members. Over half of all the scam warning signs identified over the month were fee related, including members lack of understanding of the fees involved, which could indicate members are transferring to arrangements that could be detrimental to their retirement outcomes.”

Chart 1 – XPS Transfer Value and Transfer Activity Index

Chart 2 – XPS Red Flag Index

Related links

- Register for events

- Join our mailing list

Register for events

We enjoy hosting a wide range of events for pension scheme trustees, corporate sponsors, independent trustees, and pensions professionals.

Join our mailing list

Keep up to date with our latest news and views including pension briefings, XPS insights, reports and event invitations.