Is your scheme’s well-hedged LDI strategy more exposed to RPI reform than you think?

Is your scheme’s well-hedged LDI strategy more exposed to RPI reform than you think?

02 Mar 2020

On the 11 March 2020 the Treasury is launching a consultation looking at how RPI will be calculated in the future.

It is expected to focus on the timing of any change from RPI to CPIH which may occur at some point between 2025 and 2030.

This change introduces a considerable degree of uncertainty in estimating future inflation for both liability assumptions and returns on index-linked gilts. These risks are already widely recognised, being of particular note for schemes with CPI-linked liabilities and schemes that have RPI liabilities that are not fully hedged.

However, XPS is concerned that some issues have not been given sufficient attention. Specifically, schemes with RPI-linked liabilities and a high level of hedging may not be immune to impact. The RPI/CPI issue has scope to magnify approximations within pension schemes’ liability hedging, leaving schemes more exposed than they might realise.

This issue is particularly acute for schemes who employ:

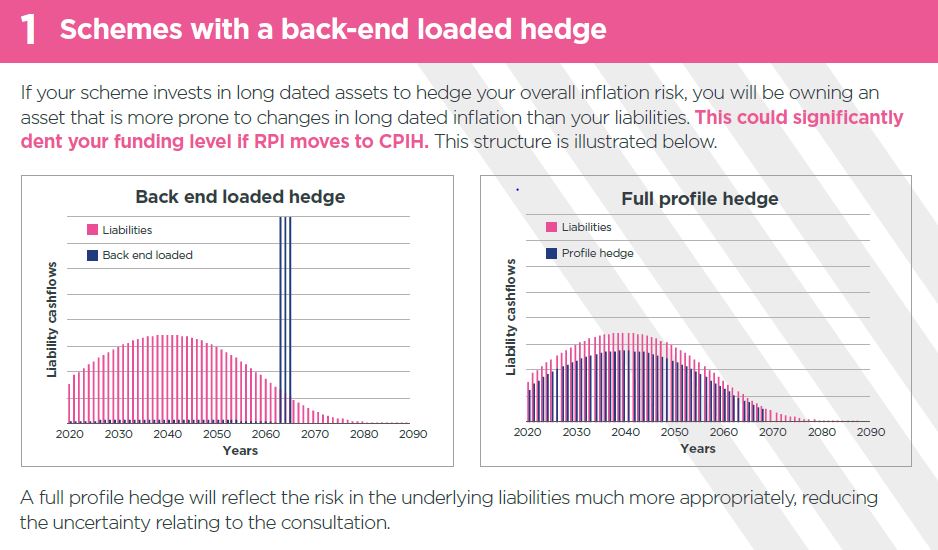

- a back-end loaded hedging strategy – commonly employed to circumvent the use of leverage; or

- a high degree of hedging across the full profile of liabilities but with a cashflow benchmark that has not been comprehensively modelled using ‘3D’ cashflows.

"Being well hedged on inflation is a question of quality as well as quantity. With the current RPI issue this has never been more true."

Simeon Willis – Partner, Chief Investment Officer

The issue

In theory, where schemes are hedging RPI-linked liabilities with RPI-linked assets, any fluctuation will be mirrored in assets and liabilities, neutralising each other. However in practice any mismatch between the liabilities and the hedge can cause notable issues.

Practically all pension scheme LDI hedging strategies involve some mismatch between their projected liabilities and their actual cashflows. This is known as ‘curve risk’ and is usually a lower order risk when compared to ‘duration risk’, which relates to the broad overall exposure to interest rate and inflation risk.

In relation to the consultation, the RPI calculation is not expected to materially change in the next 5 years, but it might change from then on. It is also more likely to change from 2030 onwards than from 2025. Therefore, any mismatch between the maturity of the liabilities and RPI-linked hedging assets becomes more prominent.

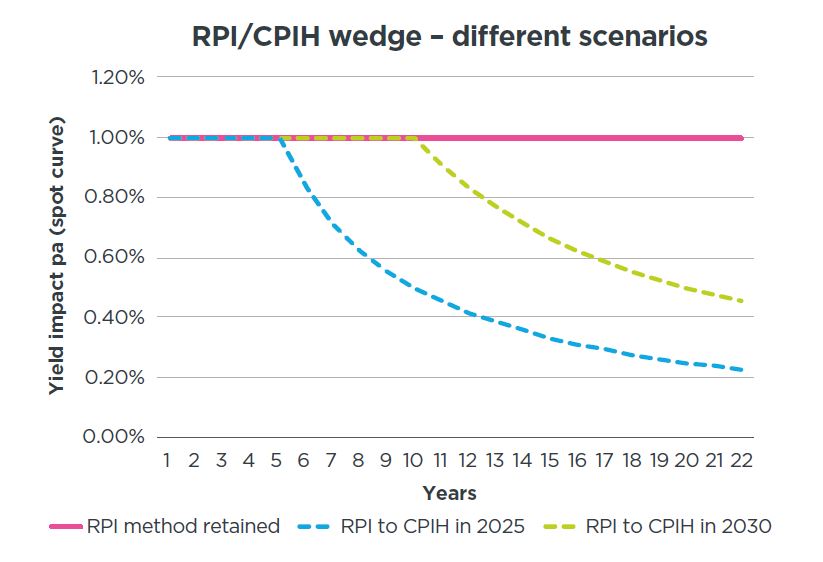

Whilst we don’t know what inflation will be in the future, we can look at the expected difference between RPI and CPI in the future to look at the potential impact under different scenarios. The chart below shows how you could reasonably expect the RPI/CPIH wedge to differ in response to different outcomes from the consultation, depending on whether the current RPI approach is retained, or if there is a move to CPIH in either 2025 or 2030. We have shown the additional yield you would earn from RPI over CPIH in the different scenarios. Any fall in yield is a direct reduction in the return the investor receives from their RPI-linked assets.

We have calculated these movements assuming that the difference between the existing RPI method and CPIH (the wedge) is 1%.

Based on our observations of the pricing in the RPI/CPI basis swap market, current market expectations are broadly in between the two extreme outcomes of no change to RPI, and moving to CPIH in 2025. This means that depending on the outcome of the consultation, index-linked gilt returns could improve or deteriorate relative to current expectations. It is important to appreciate that this is therefore not a one-way risk because the market is already pricing in expectations of what might happen.

Of greatest relevance to the question on the hedge structure is that the chart highlights that longer-dated assets are more exposed to this risk than shorter-dated assets. So the impact is greater, both in terms of upside and downside, for holding longer dated assets if these do not match your liabilities correctly.

Areas of particular concern for schemes

Actions you can take

For schemes in either situation it is important to assess the current hedging strategy in light of the specific issue:

- Schemes that employ a long-dated index-linked gilts strategy should assess whether their hedging strategy is disproportionately exposed to risk of loss in the event that RPI moves to a CPIH methodology at some point between 2025 and 2030.

If it is, you could reduce this risk by replacing the exposure using a more balanced hedge across the full profile of the liabilities, using a proprietary pooled LDI profile fund, for example.

- Schemes that have a high level of hedging which is not founded upon detailed ‘3D’ cashflow projections should check with their investment consultant and Actuary if the nature of their membership means that more of their inflation exposure is short dated than is currently reflected in the LDI benchmark.

If so, the LDI hedge benchmark of the LDI manager could be revised to address this shortcoming.

For further information, please get in touch with Simeon Willis.

- Register for events

- Join our mailing list

Register for events

We enjoy hosting a wide range of events for pension scheme trustees, corporate sponsors, independent trustees, and pensions professionals.

Join our mailing list

Keep up to date with our latest news and views including pension briefings, XPS insights, reports and event invitations.