Uncertainty weighs on investor sentiment

Uncertainty weighs on investor sentiment

05 Aug 2021

XPS Investment Monthly Update

Month in brief

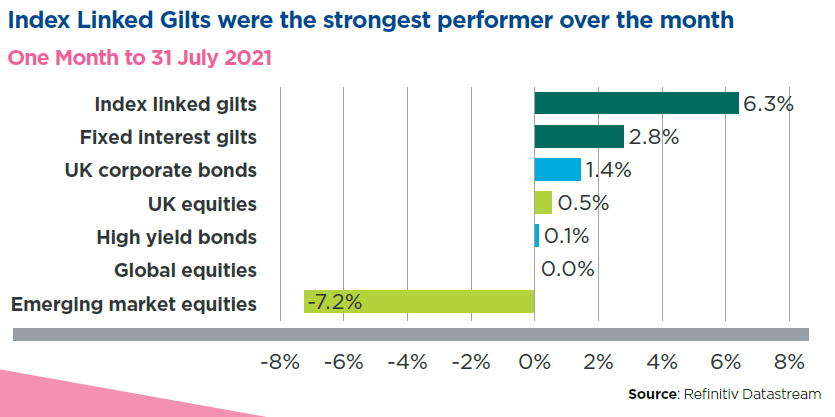

- Developed equity markets were broadly flat over the month albeit performance over the past year remains very strong

- Index-linked and nominal gilt yields fell significantly amidst growing inflationary pressures

- The funding level of a typical scheme is likely to have decreased

Returns from developed equity markets were muted and bond yields fell during July as concerns about the impact of the Delta Covid variant on the economic recovery, coupled with growing inflationary pressures, weighed negatively on investor sentiment.

In the UK, CPI inflation exceeded the Bank of England’s (BoE) 2% target for the second consecutive month, and the members of the BoE’s Monetary Policy Committee had mixed views over whether the current monetary stimulus should be scaled back. Despite a rise in cases, the remaining COVID restrictions were lifted on 19 July, in light of the vaccination uptake. ‘Pingdemic’ resulted in nationwide staff and supply shortages, leading to worries about a temporary stall in the recovery. Despite this, economic output is expected to be closer to pre-pandemic levels this year.

In the US, ten-year Treasury yields fell to their lowest level since February as the US Federal Reserve (Fed) opted to keep interest rates and its bond buying programme unchanged. CPI inflation rose by 0.9% in June, the largest monthly increase since 2008, bringing the annual increase to 5.4%. The Fed maintained its stance that inflationary pressures were transitory, and that the US economic recovery needed to progress further before monetary support was tapered.

Despite rising infection rates, the European Commission increased its eurozone economic growth forecasts. The European Central Bank (ECB) reiterated that interest rates were expected to remain at current or lower levels until inflation consistently exceeded its 2% target. Bond yields moved lower across the continent as a result.

Elsewhere, the Tokyo Olympics went ahead, despite a surge in COVID-19 cases in the Japanese capital, and a number of other countries have imposed further restrictions as the Delta variant spreads. Towards the end of the month, shares of Chinese companies listed in the US saw their biggest two-day fall since the 2008 financial crisis after a series of crackdowns by Beijing on its technology and education industries. Companies such as Tencent and Alibaba, which form a significant part of emerging market equity indices, saw sharp falls as a result.

With growing inflationary pressures and ongoing discussions around monetary support, index-linked and nominal gilt yields fell materially over the month. Credit spreads increased across the investment grade and high yield bond markets.

A significant fall in gilt yields in conjunction with muted equity performance meant that the funding level of a typical pension scheme would likely have decreased over the month, we estimate by just under 1%.

To discuss any of the issues covered in this edition, please get in touch with Beatrice Stanoescu, or your usual XPS contact.