Ukraine – assessing the impact on pension investments

Ukraine – assessing the impact on pension investments

02 Mar 2022

Simeon Willis, Chief Investment Officer, assesses the extent that the war in Ukraine could feed through to a UK pension scheme’s funding position. We take a look at the key drivers of liability valuation and the major asset classes to highlight direct and indirect exposures that different schemes may have, summarising immediate actions that trustees could take in response.

How have markets reacted to the Russian invasion

The full scale invasion of Ukraine began in the early hours of the 24th February following several months of Russian forces building up around the Ukrainian border. The potential for an invasion was recognised by governments worldwide – despite the unconvincing claims of Vladimir Putin of having no intention of doing so.

Attributing market movements to specific events is problematic. In this note we’ve focused on market movements over the last two months given it is reasonable to assume that the possibility of this event was being factored into market pricing during that time, albeit partially.

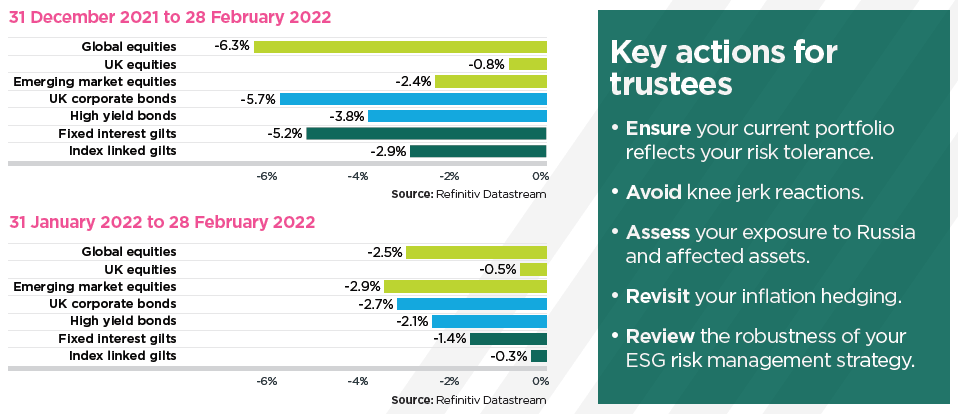

The charts below show the returns on markets to date since the end of January. It is not possible to separate out the specific impact of this crisis but it is clear that a large amount of market repricing has already taken place reflecting the collective unease at market levels.

A typical scheme’s funding position is likely to have deteriorated since the start of the year, driven by falls in growth assets and a rise in expected inflation. Further to this, on the 1st of March as this paper was going to print, gilts yields fell substantially which would have further impacted funding levels.

Impact on pension scheme liabilities

Inflation expectations

A prominent issue for investors arising from this crisis is the further upwards pressure on inflation. Russia and Ukraine both contribute meaningfully to the worldwide supply of commodities. Oil and gas have already been experiencing supply side shortages leading to sharp rises in energy prices. The UK’s CPI inflation measure rose by 5.4% over the 12 months to December 2021.

By way of illustration, Ukraine and Russia account for around 25% of the global production of wheat. Ukraine also accounts for almost half of the global supply of sunflower oil.

Cost-push inflation, which refers to price rises that result from a reduction of supply, rather than an increase in demand, is more difficult for central banks to manage through conventional monetary policy i.e. increasing interest rates. This introduces a particular challenge for central banks who have already begun tip toeing through the post-COVID-19 recovery, and will be cautious to avoid inadvertently creating a stagflation environment – where inflation persists alongside a new recession.

Long term gilt yields

The challenge of exactly how central banks will manage inflation resulting from commodity supply disruptions creates scope for interest rates to move in different directions. On one hand we could observe a hastening of rate rises to further control inflation. Alternatively, we may see a slowing of rate rises given the potential for consumer confidence to be materially dented by the war. Initial signs appear to be that the recent developments in Ukraine will, if anything, dampen the rate of increases by the US Federal Reserve.

Whilst long dated gilt yields are to some extent connected to short term sterling interest rates, the drivers of gilt yields are more complex and have historically been seen to move largely independently of short term rates. The current headwinds put downward pressure on yields due to the attractive defensive characteristics of government backed debt, but current news is already priced-in, meaning that the future direction for yields is no more or less predictable than it was previously.

Impact on pension scheme assets

Emerging market equities

The Russian stock market, represented by the MOEX index, fell 33% on the 24th February. Russia is one of the ‘BRIC’ economies (Brazil, Russia, India and China), an acronym created by Lord Jim O’Neill of Goldman Sachs in 2001 to reflect the four developing countries that sat at the heart of the emerging markets’ growth. Despite this labelling, Russia is a surprisingly small component of the MSCI Emerging Markets index at less than 3%. This compares with China which is around 30%.

Ukraine does not feature in the Emerging Market index, nor does it feature in the next index down, the Frontier Markets index. The likelihood of a typical emerging market equity portfolio having direct equity investments in Ukraine is therefore very remote.

As such, investors in a typical passive emerging market equity investment will not have a large direct exposure to companies listed in either country, although there is still scope for other emerging market countries and companies to be affected adversely.

For schemes with investments in emerging market equities, it may be helpful to review your direct exposures to Russia.

Global developed market equities

Contrary to conventional wisdom, developed market equities do include some direct exposure to Russian stocks. Examples in the FTSE 350 include Polymetal, Evraz and Ferrexpo. These only account for a small percentage exposure but more widely companies will be affected where there is a reliance on Russia and Ukraine in their supply chain. For example, Volkswagen has announced it is partially closing two of its German car factories following the invasion, in light of being unable to secure electrical wires from manufacturers in Ukraine.

Also, due to the complex ownership structure of companies, there will be examples of Russian companies being owned by other companies based in developed regions. For instance, BP owns a sizeable minority shareholding in Rosneft and this holding accounted for almost a fifth of BP’s profits in 2021. BP has publicly stated since the invasion that it will sell its stake in the company. Another example is Shell, which holds meaningful stakes in various Gazprom projects with a similar commitment to divest.

Surprise rises in inflation puts pressure on companies to pass through costs to customers. This rarely insulates the company from any impact. Historically, equities have tended to fare worse when inflation has been well above expectations.

In short, equity markets are likely to remain volatile for the time being.

Emerging market debt

An allocation to investment grade Emerging Market debt may include Russian debt which was previously BBB rated. S&P have downgraded it to sub investment grade since the invasion and subsequent sanctions placed on the country.

As with equities, the exposure within bond indices is relatively small. Russia represented less than 5% of the dollar denominated government bond index, JP Morgan EMBI Global Diversified; and less than 10% of the smaller local-currency government bond index JP Morgan GBI-EM.

Credit default swap spreads on Russian debt spiked, rising to over 9% at one point following the invasion. This reflects legitimate concerns over default by Russia combined with scope that an escalation of sanctions hinders the receipt of interest and principal payments by investors.

Ukraine’s government debt was rated sub investment grade, so wouldn’t have featured in a typical investment grade Emerging Market debt portfolio, but could feature in higher risk emerging market debt strategies.

If you are invested in emerging market debt you may benefit from an assessment of your direct exposures.

Sterling corporate bonds

Whilst a sterling corporate bond investment will not have direct exposure to Russian or Ukrainian government debt, there are examples of Russian companies that have issued debt in the investment grade sterling market such as Gazprom. These holdings do not make up a meaningful exposure to sterling indices however.

There are numerous pathways by which investors in sterling debt may be affected in the short term. General investor sentiment can drive credit spreads wider which doesn’t itself reflect increased risk of default or expected loss in the longer term. On the flip side, investment grade corporate bonds are a defensive investment and may indeed be supported from a flight to quality from other riskier asset classes such as equities.

ESG and sustainability

The nature of these direct and indirect exposures to Russia remind us of the relevance of having investments that align with trustees’ desired Environment, Social and Governance approach. Whilst exclusion of Russian assets from investments may be one approach, the complex reality may mean this blanket approach is insufficient to achieve what’s desired. If there are concerns about holding companies that are associated with Russia or that employ wider practices that might fall below your expectations, this can be addressed more holistically through employing a more sustainable investment approach. These employ a range of sophisticated techniques to seek to avoid assets with harmful associations. This could help in the longer term by avoiding investment in a range of high risk areas which may pose an issue in the future.

Outlook

The scope for the situation to deteriorate further is self-evident, but it is also vital to keep in mind that other risks remain. There remains potential for escalation between China and Taiwan as well as a number of other risk factors, not least the global recovery from COVID-19. Markets are forward looking and therefore current news and the potential for further deterioration is already factored in into prices. Consequently this does not represent a sensible time for wholescale changes in strategy.

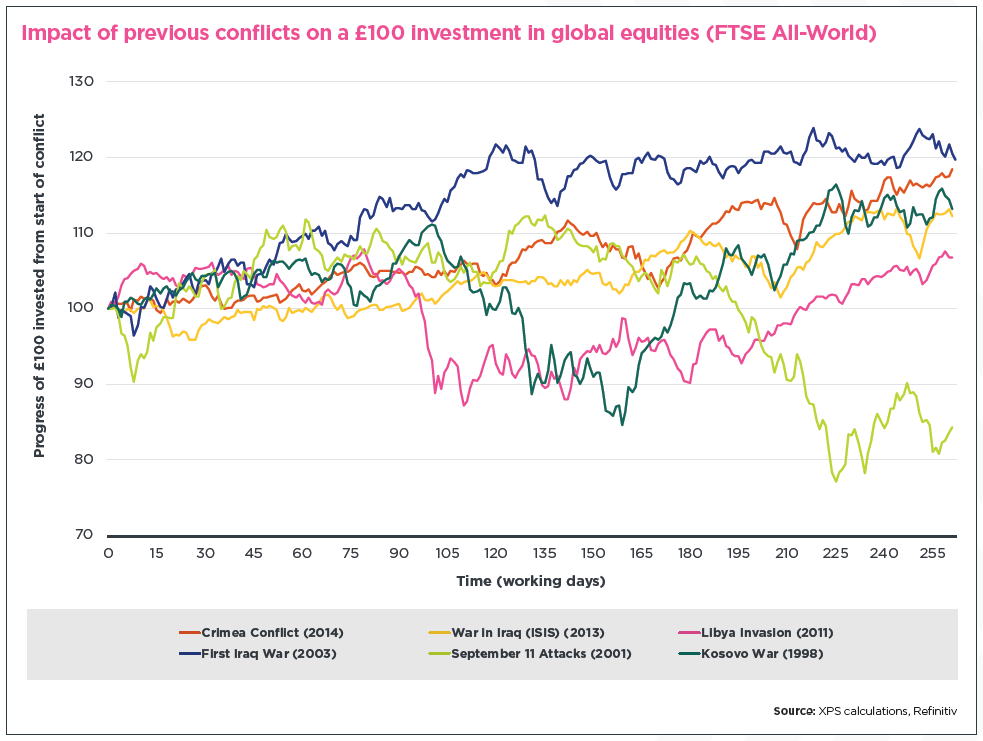

This is reinforced in the chart below that plots the medium to longer term market reactions to various conflicts over the last 30 years.

Whilst there is no decipherable pattern, the chart highlights the breadth of variables that affect market prices and that in the longer term equities markets do offer a reward for the risk that inevitably comes with sharing in the profits of a diversified portfolio of companies. This adds support to the well-known adage that ‘time in the market is better than timing the market’.

That said, if your portfolio does not currently reflect your risk tolerance and you wish to make changes, it is important to recognise the significant intra-day price fluctuations. This can be managed by approaches such as pre-investing trades to reduce time out of the market and breaking up transactions across a number of smaller trades.

"The market already knows what we know and has priced it in. Timing the market can be a perilous activity in any market environment, but particularly so currently."

For further information, please get in touch with Simeon Willis.