Markets swing wildly during February increasing volatility for pension schemes

Markets swing wildly during February increasing volatility for pension schemes

07 Mar 2022

Month in brief

- Putin launches Russian military invasion of Ukraine creating a humanitarian crisis

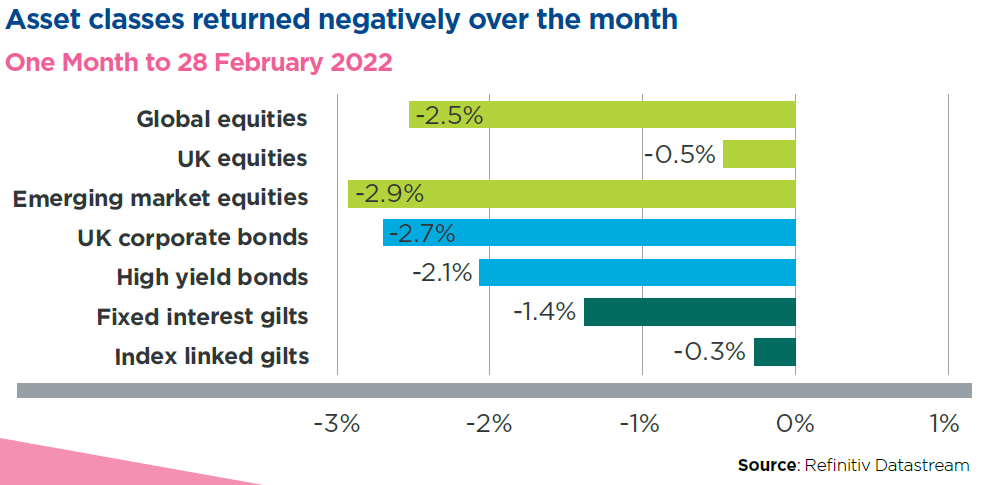

- Global markets suffer poor returns over the month, with both equity and bond markets falling materially

- Gilt yields fell sharply towards the end of February and on 1 March

Vladimir Putin launched a full-scale military invasion of Ukraine on 24 February. The invasion has sent shockwaves around the world and created a humanitarian

crisis in Ukraine.

Equity markets shifted violently during the day of the invasion but there was large dispersion between regional returns; US equities closed 1.5% higher, rebounding from a loss of as much as 2.6% earlier on in the day, but the European Stoxx 600 index closed 3.3% down. Russia’s equity benchmark, the MOEX index, fell 45% before climbing back to a 33% loss.

The wider potential direct and indirect economic impacts became clearer over the last few days of February after countries around the world announced a raft of severe sanctions on Russia’s economy and specific Russian individuals in response. Much uncertainty remains, however, and equity and bond markets have remained volatile as a result.

Economic shocks are expected worldwide given trade links with the two countries, as well as a heavy reliance on Russian oil and gas. Companies globally have begun attempting to sell Russian assets so as to distance themselves from Russia.

Commodity prices spiked and have remained elevated given Russia and Ukraine’s importance in producing and exporting a range of core commodities. Coupled with existing supply chain disruption, this has contributed further significant upward pressure on inflation levels.

This all creates a difficult backdrop for central banks to navigate and has potential to lead to a stagflationary environment, where stagnating growth is coupled with high inflation. It appears that previously planned central bank interest rates rises will continue albeit the expectation is this will be slightly more gradual.

More generally, the escalation of the conflict, coupled with planned central bank tightening and inflation concerns, have left equity and bond markets with heavy losses for the period.

The rise in gilt yields seen since early-December dipped downwards at the end of February as investors moved into perceived ‘safe-haven’ assets. Following the end of the month gilt yields experienced a further sharp fall on the 1st of March.

Economic data released before the invasion was generally favourable and reflected continued strong growth as concerns over the Covid-19 variant, Omicron, continued to fade and business activity picked back up. The Bank of England raised the Bank rate from 0.25% to 0.5% at the beginning of February.

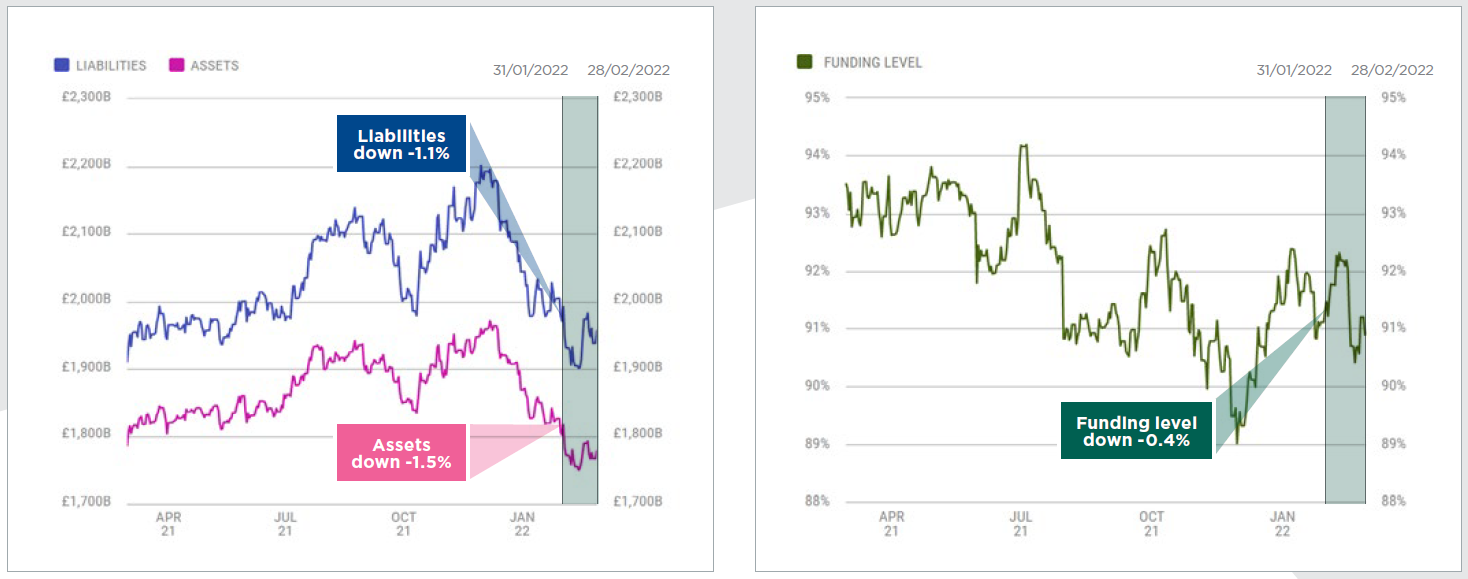

The estimated aggregate funding position of UK DB pension schemes, on a long-term basis, fell over February, as a result of falling growth asset values and rising inflation expectations.

Source: XPS DB:UK

The charts above are based on data from The Pensions Regulator, the PPF 7800 Index and the XPS data pool. The assumptions used in the UK:DB long-term target basis include a discount interest rate of gilt yields plus 0.5%. The assumed asset allocation is 16.9% equities, 20.0% corporate bonds, 6.9% multi-asset, 5.1% property, 3.8% private markets and 47.3% in liability driven investment (LDI) with the LDI overlay providing a 60% hedge on inflation and interest rates.

For further information, please get in touch with Arfah Jawid.