Impact of COVID-19 on transfers from defined benefit pension schemes

Impact of COVID-19 on transfers from defined benefit pension schemes

09 Apr 2020

What you need to know

- Current volatile market conditions in the wake of the COVID-19 outbreak mean trustees must consider impact on defined benefit (DB) transfer values.

- Schemes with lower protection against market movements may find transfer values are no longer affordable at their current level. Trustees can reduce transfer values to reflect underfunding.

- Some schemes are seeing an increase in member queries and transfer requests. Members may be concerned about their own finances, as well as the position of the pension scheme and sponsoring employer.

- Members are now at greater risk of making poor decisions or falling victim to a pension scam.

- The Pensions Regulator (TPR) has stated that no regulatory action will be taken, until 30 June 2020, against trustees who breach statutory deadlines due to suspending transfer values.

Actions you must take

- Review transfer value affordability – most schemes should be able to maintain values at their current levels but those with a high number of requests or whose funding level has fallen significantly may reduce or suspend.

- Review scam protection and improve if needed – scams are on the rise and direct engagement with members is needed to warn them of heightened risks.

- Help members access high quality financial advice – it is more important than ever to have a high quality financial adviser in place to support members with their decisions.

- Review your communications strategy – proactive engagement with members can allay concerns about security of benefits and will provide members with information about transfers and the associated risks in line with regulatory guidance.

How our clients are responding

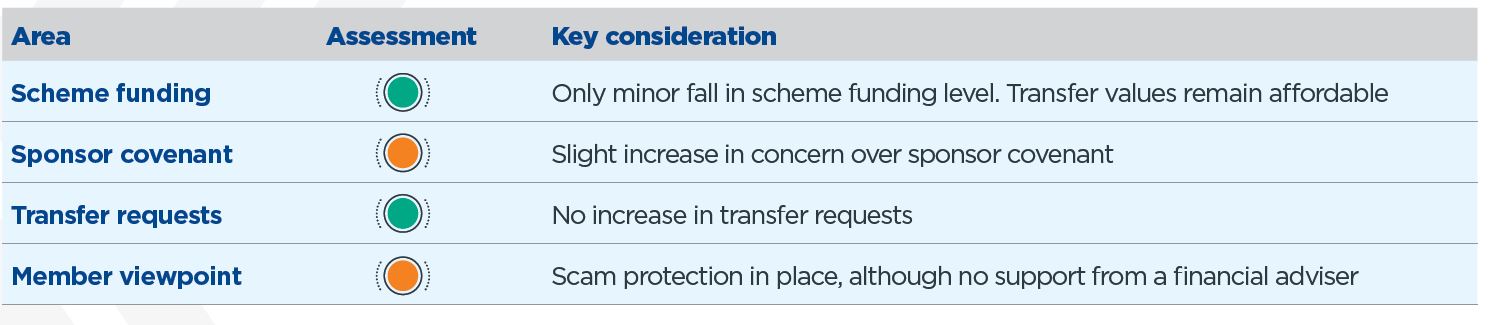

We are carrying out a rolling survey of the pension schemes we work with post TPR guidance on 27 March 2020. The results as at 3 April 2020 are as follows:

Case studies: When should schemes suspend transfer values?

Trustees and sponsors may be concerned about continuing to quote transfer values in light of the recent market volatility and the expected increase in pension scam activity. However, after consideration we are seeing the majority of pension schemes decide they are able to continue paying transfers, alongside the appropriate protections for members.

We have set out how we are helping trustees decide whether to suspend transfers, with two case studies.

Framework for assessing whether to suspend transfer payments

Case study 1: Scheme continuing to quote transfer values

Case study 2: Transfer value quotations suspended whilst trustees take further advice

For further information, please get in touch with Helen Ross or Mark Barlow or speak to your usual XPS Pensions contact.