Global government bonds sell-off benefits pension schemes

Global government bonds sell-off benefits pension schemes

05 Mar 2021

XPS Investment News - March 2021

Bringing you our market round-up and the latest news affecting UK pension scheme investments.

Month in brief

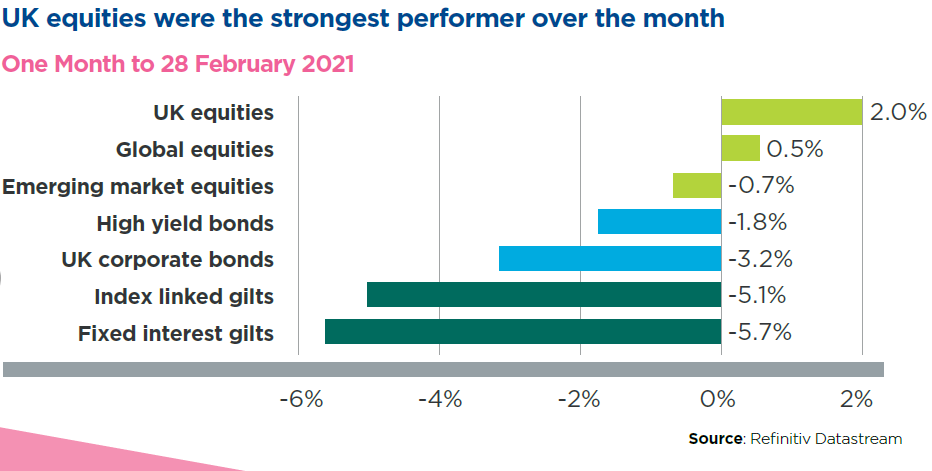

- Global government bonds sold-off sharply upon investor fears about mounting inflationary pressures

- Global equities fall back over the second half of February

- Sterling appreciates versus Dollar and Euro, detracting from overseas returns for unhedged sterling investors

February saw a sharp sell-off in global bonds with many countries experiencing sharp increases in the yields on their government bonds. UK gilt yield moves were particularly significant.

These remarkable government bond yield increases have been widely attributed to an increase in investor confidence about the future of the global economy and stronger expected economic growth amid increasing vaccinations. Investors are also concerned about mounting inflationary pressures as a result of the unprecedented level of fiscal and monetary stimulus that continues to be pumped into economies, as lockdowns ease.

The 10 year UK gilt yield rose by 0.5% over February, the largest monthly increase in the last 10 years, taking it to its highest yield for over a year. Long term UK inflation expectations rose modestly but not enough to offset the increase in UK real yields, meaning that most pension schemes will have benefitted, by some degree, from the gilt yield rises.

A similar picture was seen in US Treasury yields, with the Federal Reserve reassuring markets that policy continues to be supportive along with the House of Representatives passing Joe Biden’s $1.9 trillion coronavirus relief package. Elsewhere, European bonds, including French, German and Italian government bonds, also saw yields rise materially.

Global equity markets had a good first half of the month but struggled in the second half, only just ending in positive territory for the month overall. The fall in value was, in part, attributable to the sell-off in government bonds, as an increase in yields decreases the present value of future equity earnings. The VIX, a measure of equity market volatility, remained elevated but temporarily fell below 20 for the first time since the beginning of the Covid-19 crisis, before increasing again towards the end of the month.

Economic data released over the month showed that the UK economy recorded its worst economic performance for more than 300 years in 2020, falling 9.9%. Whilst the economy grew 1% over the last quarter, output is still materially below its pre-pandemic peak. January retail sales figures in the UK fell below expectations and Boris Johnson unveiled his plan to end England’s lockdown.

Sterling made gains against both the US Dollar and Euro, ending the month at levels not seen against the US Dollar since mid-2018. This will have detracted from unhedged overseas returns for Sterling investors.

The funding level of a typical scheme would have improved over the quarter as a result of a larger fall in liability values than asset values over the period.

To discuss any of the issues covered in this edition, please get in touch with Steven Hickey or your usual XPS contact.