An eventful month to start the year

An eventful month to start the year

06 Feb 2020

XPS Investment News - February 2020

Bringing you our market round-up and the latest news affecting UK pension scheme investments

Month in brief

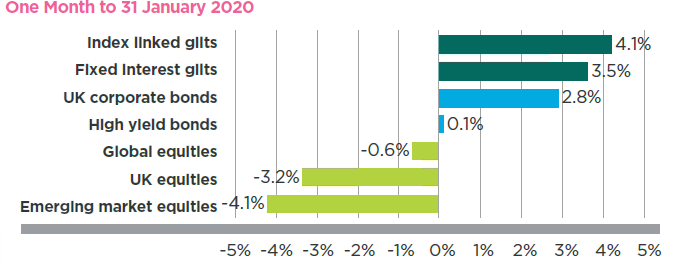

- Equity markets were volatile over the period, finishing the month with negative returns

- The US and China signed ‘phase one’ of their trade deal, but US tensions with Iran heightened

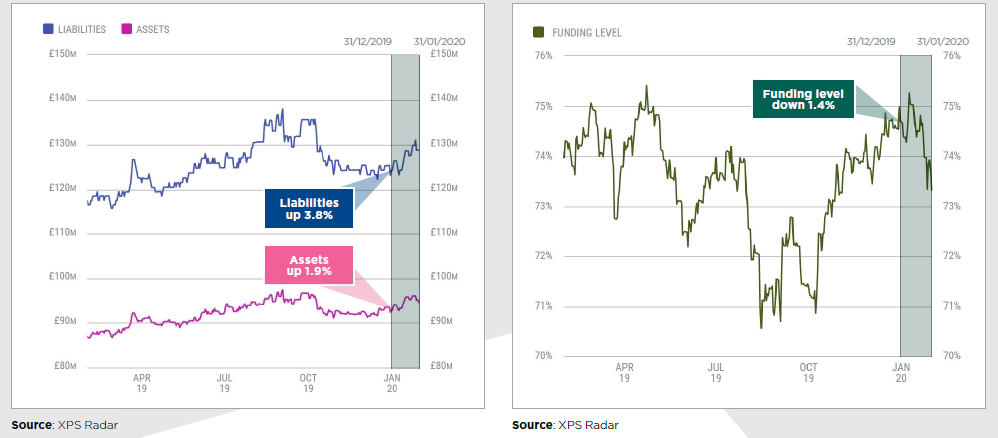

- The funding level of a typical scheme would have decreased owing to material falls in government bond yields

The year began with a dramatic escalation of already heightened tensions between the US and Iran, after the US carried out a targeted military attack on a high ranking Iranian general. However, a muted Iranian response and de-escalatory rhetoric provided much needed reassurance for markets. Equities suffered a momentary blip before rising to a peak in mid-January, only to then fall off materially by the end of the month.

The German industrial slump deepened, and figures released revealed that China’s GDP grew at its slowest rate since 1990 in 2019, underperforming analysts’ expectations. These fears were compounded by the uncertainty surrounding the severity of coronavirus, and its potential impact on a slowing Chinese economy, and other countries globally. Oil prices fell over concerns around the knock-on effects that this could have on oil demand.

This negative sentiment outweighed the relief offered after the US and China announced that they had signed ‘phase one’ of their trade deal. The agreement leaves the vast majority of current US tariffs on $360bn of Chinese goods in place, but puts an indefinite hold on future additional tariffs being levied on Chinese goods. Tensions surrounding US and EU trade were also lifted after Trump vowed to press ahead with trade talks in order to reach a trade deal with the EU before November’s presidential election.

The UK formally left the EU on 31 January. Attentions will now turn to the trade negotiations that will decide the UK’s future relationship with the bloc. UK inflation fell to its lowest level in more than 3 years, and retail figures showed a continued contraction over December. The Bank of England kept interest rates unchanged and indicated its central expectation of economic improvement, but if this fails to materialise, a rate cut may be required to support inflation.

Index linked gilts were the strongest performer over the month

Source: Refinitiv Datastream

Government bond yields fell materially over the month pushing liability values up. Any asset growth was primarily attributable to liability hedging. This would have resulted in a decrease in the funding level of a typical scheme over the period.

The typical scheme used has an assumed asset allocation of 27% equities, 34% corporate bonds, 11.6% multi-asset, 4.8% property and 25% in liability driven investment (LDI) with the LDI overlay providing a 50% hedge on inflation and interest rates. This example scheme was 80% funded in 2015.

To discuss any of the issues covered in this edition, please get in touch with Sarita Gosrani. Alternatively, please speak to your usual XPS contact.

- Register for events

- Join our mailing list

Register for events

We enjoy hosting a wide range of events for pension scheme trustees, corporate sponsors, independent trustees, and pensions professionals.

Join our mailing list

Keep up to date with our latest news and views including pension briefings, XPS insights, reports and event invitations.