ESG Integration: How Fiduciary Managers stack up

ESG Integration: How Fiduciary Managers stack up

25 Feb 2020

Whilst the recent fiduciary management industry focus has been on the results of the CMA review, in this note we step back and highlight the important topic of ESG integration and provide an overview of its application within fiduciary management.

Society is placing greater emphasis on companies behaving in a responsible way. This expectation extends beyond the company’s direct activity, permeating the supply chain and knock-on impact of its operations. Pension schemes are now legally required to document their approach towards managing material non-financial risks and in October 2020 will have to start reporting on how this is being implemented. Appropriate management of material risks associated with Environmental, Social and Governance (ESG) issues within the selection and ongoing stewardship of assets is not a ‘nice to have’, it is a fundamental component of investment management.

ESG integration and stewardship within fiduciary management

- We define ESG integration as being the consideration of ESG risks when deciding whether or not to invest in a company. Stewardship is then the activity of voting and engaging with the company you are invested in, to steer it in the desired direction. Both aspects are now widely accepted features of good quality asset management.

- As pension scheme trustees use the expertise of investment managers to invest their assets, they also delegate the important aspect of integrating ESG factors and the stewardship of their assets to their investment managers. Whilst in the past this was considered a satisfactory approach, there is an increasing focus from policy makers requiring asset owners, i.e. trustees, to take a more active role. This is highlighted in the update to the voluntary Stewardship Code by the Financial Reporting Council and the recently introduced DWP requirements, which we view as just the beginning of a wave of regulations to come.

- Fiduciary managers surveyed control over £170 billion of assets – around 90% of UK fiduciary mandates. Depending on the level of delegation, trustees may not have control over the selection of underlying managers utilised in their portfolio. They are therefore reliant on the fiduciary manager’s (‘FM’) approach to incorporating ESG unless they have a bespoke policy being implemented on their behalf. This means that it is crucial that all pension scheme trustees understand the processes and practices employed by their investment or fiduciary managers to ensure that the approach employed is aligned to trustees’ stated approaches and their expectations.

Assessment of ESG integration in fiduciary management

As part of our ongoing FM Watch research we have carried out detailed analysis on 16 firms that have a fiduciary management offering through a combination of detailed questionnaires and face-to-face meetings over the second half of 2019. Our assessment was focussed on 4 key elements:

1 Philosophy

We explored the extent to which ESG featured within the FMs’ overall mind-set.

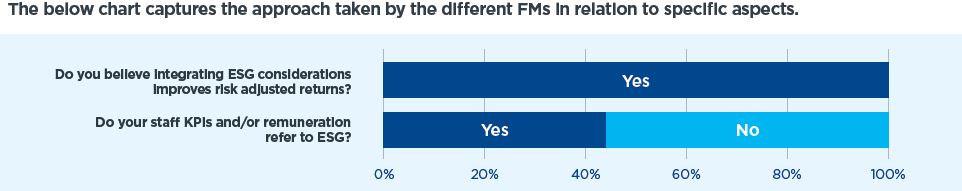

At a headline level, all of the FMs we surveyed have a formal policy relating to the incorporation of ESG within their processes. All FMs believe that ESG considerations can improve risk-adjusted returns.

With this in mind, it is no surprise that a vast majority of FMs have dedicated ESG teams and resource to help drive their efforts across their respective firms. We found however that size, experience and interactions of the ESG team with the wider investment teams and key decision makers vary across FMs. For example, the size of ESG teams ranges from 3 to around 40.

A number of FMs also reflect ESG integration in staff objectives and/or remuneration. This is a growing theme in the industry, which we believe is positive and reflective of a firm’s commitment to ensuring ESG is embedded in their processes.

XPS View

We find that there is strong positive momentum amongst FMs to formalise their approach and dedicate resource to this area. However, firm-level policies should not be used in isolation to evidence the application of ESG within the underlying portfolios. In our experience, the assumption that firm-wide policies are universally applied across a fund management organisation is often ill founded. This has contributed to the theme in the broader investment industry known as ‘greenwashing’, where asset managers claim to employ responsible investment practices but in fact do not.

2 ESG integration in practice

This area is arguably the most important and draws out the greatest distinction between the various FMs.

As the majority of FMs construct portfolios by investing in third party funds, undertaking due diligence in respect of ESG considerations within underlying funds is the primary means that ESG is incorporated and should form a core part of the firms’ manager selection and portfolio construction processes.

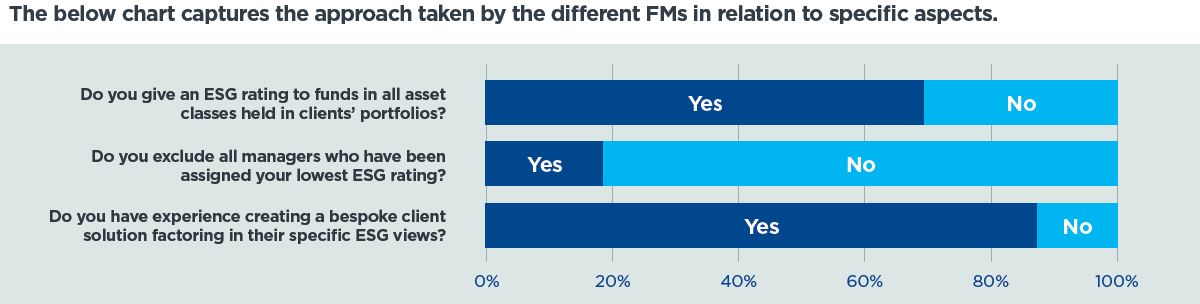

All the FMs we surveyed employ some form of analysis or scoring methodology to assess the underlying managers’ responsible investing capabilities – once again, an indicator of positive momentum. The methodologies however, differ depending on the FM’s capabilities, availability of resource and overall view. For example, whilst most managers say they integrate ESG across all asset classes, upon closer inspection we found that equities had the highest coverage but the extent to which it is incorporated within fixed income and alternatives varies by manager.

The true contrast however comes through in how the ESG ratings are subsequently used by FMs. Only three FMs currently exclude underlying funds that receive their lowest ESG ratings based on their due diligence. However, a handful of FMs signalled towards making changes to their research process in the future to take this sort of approach. We also observed that the demand on FMs for greater ESG integration from their European clients has had a beneficial impact on their overall approach.

Most of the FMs surveyed have the capability to implement bespoke solutions to reflect specific Trustee views or ESG policies particularly for larger clients. However, schemes below £250m tend to be put in ‘one size fits all’ solutions with few options to reflect their specific views in terms of the selection of funds that might fit a desired ESG approach. This could however change as demand for such solutions increases.

XPS View

As the fund management industry is quickly catching up on the application of ESG within all asset classes, we expect that FMs will follow. Furthermore, we expect more FMs to start taking a stronger stance to engage more proactively with underlying managers that have responsible investing practices, with the possibility of exclusion. This will, in turn, start to raise standards and drive positive practices across the industry.

3 Stewardship of assets

Stewardship is the responsible allocation, management and oversight of capital to create long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment and society*.

It encompasses two elements: voting on equity holdings and engaging with companies to drive better practices. How a pension scheme’s assets are overseen by investment managers is a key element of responsible investing and is drawing significant attention in the industry, as reflected in the update to the 2020 UK Stewardship Code. Furthermore, engagement is not limited to equity holdings and is a powerful tool that must be used within all asset classes to drive sustainable risk-adjusted returns.

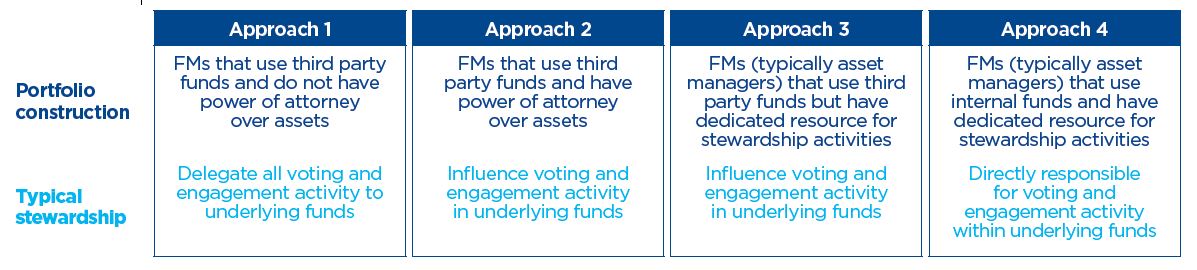

The extent to which FMs can vote and engage effectively is influenced by the way that they construct their portfolios and the underlying governance model or resource available. We categorise the primary approaches taken below:

A large proportion of FMs that sit in approaches 1, 2 and 3 delegate stewardship of assets to the underlying managers. This highlights the importance of the due diligence on the underlying managers to ensure that their voting and engagement practices are aligned with the FMs’ and trustees’ overall policy.

It was refreshing to find some FMs that are proactive in their stewardship efforts where they either utilise the expertise of third parties or have resource dedicated specifically to this area such that they can actively engage with underlying managers on stewardship matters.

Investment managers with FM offerings naturally have an advantage in this space, as they are able to lean on their internal resource and expertise. However, it must be noted that the investment industry as a whole is still evolving to raise the standard of practices in this space.

XPS View

Whilst the headline numbers appear to show there to be wide adoption, our detailed findings suggest that there is a lot more work to be done by the FMs in this space. As the majority of FMs are not directly responsible for undertaking stewardship activities on assets, they need to make a sustained effort to ensure that the underlying managers they invest in are good stewards of assets rather than just assuming that this duty is being discharged satisfactorily.

4 Climate Change

This year, for the first time, environmental concerns dominated the top long-term risks (assessed by likelihood) in the The World Economic Forum Global Risks Report 2020. ‘Climate action failure’ and ‘extreme weather’ took the top two spots in terms of impact and likelihood over the next 10 years.

This highlights the raised awareness and urgency of action that needs to be taken around climate change.

Given that UK DB pension schemes control approximately £1.6 trillion of assets, the UK investment industry is extremely well-placed to use its influence in relation to climate change. In this regard, voting and engagement are amongst the most powerful tools that investors have to influence companies to transition their practices towards a green economy.

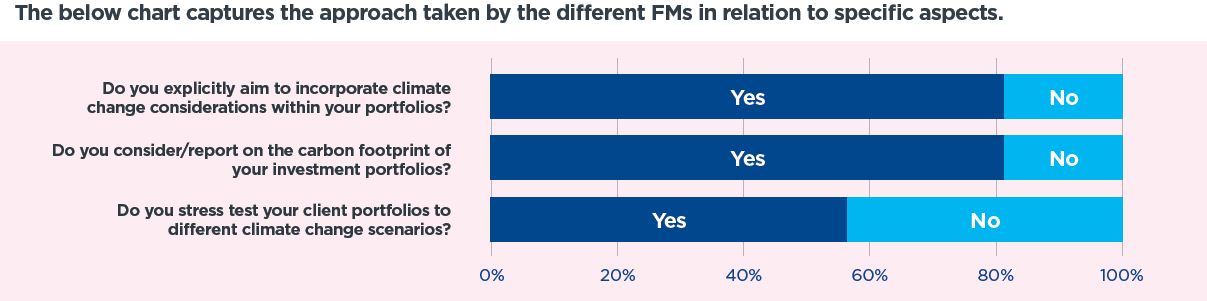

Most of the FMs we surveyed said they consider climate change considerations explicitly along with measuring the carbon footprint of their portfolios. Further to this, we found a number of FMs apply some form of stress testing in relation to climate change. Stress testing and modelling the impact of climate change is still evolving, however this an important step in the right direction that can be used to inform the decisions around portfolio construction and even liability valuations.

* Source: Financial Reporting Council

XPS View

These findings are reflective of where the industry is heading as climate change considerations grow in prominence. However we see two potential barriers to this being fully incorporated in practice. Where FMs utilise third party funds, the practices of those underlying managers in relation to climate change may not be aligned with the FMs’ views on climate change. Furthermore, engagement and voting are key to driving change, and where FMs are not proactively influencing underlying managers in relation to their stewardship priorities, alignment is not necessarily achieved. This highlights that there is more work to be done if they are to drive the necessary change.

Conclusions

It is impossible to deny that the awareness and importance around responsible investing is gaining traction with pension scheme trustees, members, the broader investment industry and society at large.

- The fiduciary management industry, as illustrated through this research, is moving in the right direction. It is apparent however, that whilst there is a focus on ESG integration and stewardship for all FMs, there is a disparity in the extent to which this is put into practice – a theme that is prevalent in the fund management industry as a whole.

- The regulations around how pension schemes consider ESG and climate change issues are getting tighter and require trustees to ensure that their investment beliefs are aligned with their investment managers and, indirectly, in the way that they invest.

- This brings with it the need for trustees to carefully understand their FM’s approach, particularly because by using this governance model trustees are one step removed from the portfolio construction process but still remain responsible for how their scheme is ultimately invested.

To discuss any of the issues covered in this edition, please get in touch with Sarita Gosrani or Charlie Stewart.

- Register for events

- Join our mailing list

Register for events

We enjoy hosting a wide range of events for pension scheme trustees, corporate sponsors, independent trustees, and pensions professionals.

Join our mailing list

Keep up to date with our latest news and views including pension briefings, XPS insights, reports and event invitations.