Equities finish 2019 with another strong quarter

Equities finish 2019 with another strong quarter

07 Jan 2020

XPS Investment News - January 2020

Bringing you our market round-up and the latest news affecting UK pension scheme investments

Month in brief

- UK equities finish the year strongly, buoyed by the General Election result

- The Pound appreciated against both the US Dollar and Euro, but remains highly volatile

- The US and China agreed Phase 1 of their trade deal in principle

Key considerations for trustees

- What should your scheme be doing in response to the revamped 2020 Stewardship code? Is it time to sign up?

- UK balanced property is an area of general concern in the market with some funds suspending trading. What action can trustees take in response to this?

Domestic news over the quarter was largely focussed around the build-up and aftermath of the UK’s December General Election. Boris Johnson’s Conservative party won a sizeable majority which gave him the mandate to press ahead with Brexit, alleviating much of the immediate Brexit uncertainty. UK equities produced strong returns over the quarter, buoyed by the result of the election, ensuring that returns for the year remained well in the double digits.

The Pound also performed strongly over the quarter, appreciating materially against both the US Dollar and Euro. However, it remained volatile and reacted negatively to news that the Withdrawal Bill, which passed parliament, was updated to ensure that the UK government cannot seek an extension to the transition period when it finishes on 31 December 2020.

UK data released over the quarter showed that the UK economy continues to struggle, particularly the manufacturing sector which had its second worst Purchasing Managers Index score since 2012 in December. Data from Germany showed that its industrial sector is suffering its steepest downturn for a decade, which is likely to weigh on overall Eurozone growth in the fourth quarter. Jobs data from the US for November remained strong, supporting the Federal Reserve’s earlier decision to keep rates unchanged.

UK retail property funds suffered large redemptions with news that the M&G retail property fund was suspending trading. The fund’s suspension came as a result of the continued redemption pressure that UK property funds have experienced over the year as investors fret about the outlook for the UK economy.

President Trump started December by escalating global trade tensions; he threated to re-impose tariffs on imports of steel and aluminium from Brazil and Argentina, impose 100% tariffs on some French goods and begin to escalate the US’s trade confrontation with the EU.

However, the quarter ended with more positive trade sentiment after Trump confirmed that Phase 1 of the trade deal with China would be signed on 15th January, although details of the agreement remain unknown. He also enacted the USMCA agreement with Canada and Mexico that is to replace NAFTA. Global equities returned positively over the month against this backdrop, capping off a strong year.

News of a US attack on the Iranian military in early January highlighted ongoing tensions, with scope to impact oil price.

UK government bond yields climbed modestly higher over the quarter but remain below levels seen at the beginning of the year.

The funding level of a typical scheme would have improved over the quarter, owing to a material decrease in liabilities outweighing modest negative asset performance.

A new decade, a new Stewardship Code

The new 2020 Code applies more principles to more investors than the previous version – so what does it mean for you?

The first Stewardship Code for institutional investors was published by the Financial Reporting Council (FRC) in July 2010 and was further revised in September 2012. This initial voluntary Code set standards around the stewardship of UK listed equities with a requirement that all FCA regulated asset managers ‘Comply or Explain’.

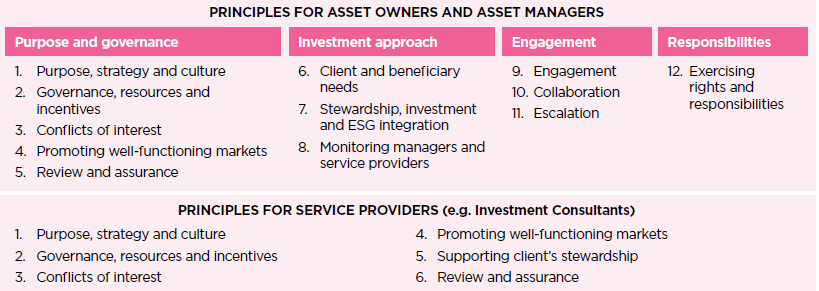

The new UK Stewardship Code 2020, which took effect from 1 January 2020, builds on the previous Code but sets higher stewardship standards across a wider range of assets, and can apply to asset owners and service providers – not just asset managers. The Code recognises that investors and the service providers play a crucial role in seeking to minimise systemic risks as well as being stewards of the investments in their portfolios.

The table below displays the 12 principles for asset owners and asset managers, and the 6 principles for service providers e.g. investment consultants, which need to be adhered to in order to comply with the Code.

Organisations wanting to become signatories to the Code must produce an annual Stewardship Report explaining how they have adhered to the Code in the previous 12 months. Potential signatories would be expected to submit their first stewardship report by 31 March 2021.

What it means for your fund managers: Fund managers are expected to adopt the higher requirements across a wider range of asset classes than just equities, including bonds, real assets, private equity and infrastructure. The Code also reflects notable market developments in sustainable investment since 2012.

What it means for pension schemes: As asset owners, trustees are now encouraged by the FRC to not only comprehend how stewardship is adopted by their investment managers but also sign up to the Code in their own capacity.

Next steps

- Reflect on how to incorporate the Code’s principles

- Monitor adoption by your asset managers

- Consider becoming a Code signatory

XPS view

The previous code was primarily aimed at asset managers but the new revised Code is aimed more broadly including pension schemes. However, signing up is not a trivial exercise, and it requires evidenced adoption of the principles. We endorse the Code and are looking for ways that we can make it easier for pension schemes of all sizes to sign up and adhere to these fundamental principles of good stewardship. We will report back as further detail emerges.

Is property out of balance?

Recent and continuing UK political uncertainty has cast a shadow around the prospects for UK property. Whilst this is undesirable, we consider the more prominent question for pension schemes to be whether UK balanced property, as a holding, can be improved upon. Recent fund innovation has led to the creation of funds that offer diversification across a wider spectrum of real assets. We consider the current property market and look at the options.

In brief

- Significant political uncertainty and poor retail performance has created concern for UK property investors

- During 2019 some property funds had to take action in response to clients seeking to disinvest their holdings, prompting wider questions of the current property market

- There are a growing number of alternative pooled investment funds that may offer a more appealing means to access property and other real assets

Since the 2016 Brexit referendum the UK Property market has been the focus of significant concern. The immediate impact in 2016 was the gating (i.e. restricted trading) of a number of leading UK property funds in light of investor withdrawals. Whilst this was relatively short lived, it has been further perpetuated by underwhelming performance. Specific concerns relate to the retail sector, as the high street sees declining demand, and lower foreign demand for UK property. Both have taken their toll and investors are looking to reduce their positions in the market.

In 2019, a rise in redemptions created liquidity issues. This led to M&G invoking the deferral of redemptions on one of their institutional property funds in May 2019, preventing investors from removing capital from their fund. In December 2019 M&G suspended trading on another property fund, this time a fund aimed at personal investors. Whilst a hindrance for investors trying to redeem their positions, this is ultimately used to protect the remaining investors to ensure that they are not adversely affected by a forced sale of assets at unfavourable prices. Personal investors commonly exhibit herd-like behaviour, which can create a domino effect across funds. This is less of a concern for institutional investors who are taking a long term view on the suitability of a property fund that trades less frequently. Investor withdrawals can however raise concerns about other property managers’ ability to meet liquidity needs more generally.

Is property out of balance?

XPS’ view on balanced UK Property

UK balanced property has historically provided a meaningful diversifying role to other return-generating assets within a pension scheme portfolio. This has been in the context of a limited range of alternatives to diversify more widely across different geographies and different property-like assets.

Alternatives

Whilst there may be concerns about the opportunities in balanced property, there are now a number of alternative property and real asset funds that we consider suitable for pension scheme investors:

Long lease property

Long Lease Property Funds invest in core property and harvest returns through long-term leases of 20+ years with strong, high quality, tenants. It provides many benefits for pension scheme investors seeking more stable income-based strategies with predictable cashflows.

Ground rents

Ground rents refers to investing in the land on which property is built, akin to a freeholder. The ground lease owner receives income based on a fixed long-term contract, often in excess of 100 years, secured on the full value of the property. They provide investors with a low risk, secure, and very long-dated income, but due to limited availability are relatively scarce.

Infrastructure equity

Whilst infrastructure has, for some time, been considered to be an ideal asset for pension schemes with steady cashflows and long-term time horizons, these assets used to be difficult to access given the prevalence of closed-ended funds with high return targets, leverage and fees. However, there are now a range of open ended, well diversified, unleveraged UK and global infrastructure funds which are ideal for pension schemes.

Other forms of secure income

There are a number of niche asset classes that can collectively be classified as ‘secure income’ ranging from asset backed securities through to property income strips and renewable energy investment, amongst others. There now exists a wide range of different secure income funds to cater for different liquidity and return targets.