Emerging issues in valuations

Emerging issues in valuations

28 Aug 2020

At a glance

It is important to consider emerging issues that will require negotiation and prepare for these in good time before your valuation

The Pensions Regulator is consulting on changes to the funding framework and we expect trustees will benchmark schemes against them

The Pensions Regulator is also asking Trustees to look at investment strategy – including future COVID-19 scenarios and if companies can still underwrite the risks. But employers should also look at the impact of COVID-19 on life expectancy to give a fuller picture

The government consultation on RPI has just closed and may impact your inflation assumptions. For more information see here

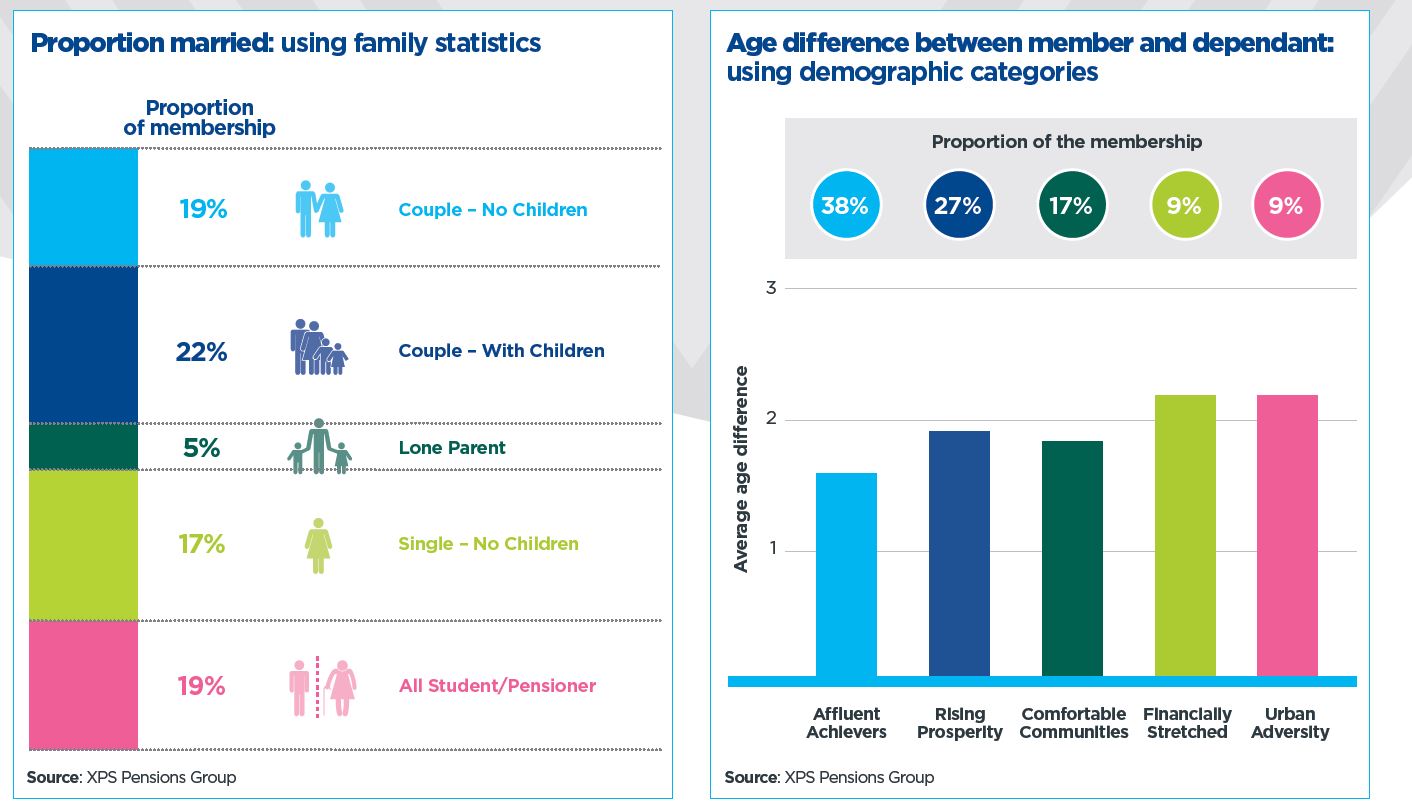

Demographic assumptions, like proportion married, can have a material impact on your valuation. New large data techniques allow you to remove unnecessary prudence from your assumptions

The new regulatory approach

The Pensions Regulator is consulting on a dual track valuation framework with detailed funding and journey plan targets. Some initial detail has been given, although it is still subject to review.

Although these are not yet in regulation, employers should be ready for trustees to benchmark their schemes against fast track.

Reviewing investment risks

When considering future COVID-19 scenarios it is important to consider the impact on life expectancy as well as the impact on investments to look at the overall picture of the scheme’s funding position.

Actions your employer can take

- Consider how your scheme’s funding compares to fast track, identify if you are ahead or behind and plan to engage on why your approach is appropriate

- Check the impact of the changes to RPI on your scheme and prepare for discussion about this with your trustees.

- Review your tolerances to pensions investment risk reflecting your current business plans and future scenarios.

- Use large data techniques to ensure your demographic assumptions reflect your scheme’s membership.

Large data techniques - understand the demographics of your membership

New techniques using large data sets allow us to consider the specific make-up of your membership and their characteristics to help identify appropriate mortality and other demographic assumptions. It is important to make sure there is no unnecessary prudence in these assumptions.

For further information, please get in touch with Vicky Mullins or Louisa Taylor or speak to your usual XPS Pensions contact.