Covenant actions for employers during current funding valuations

Covenant actions for employers during current funding valuations

29 Jul 2021

At a glance

The Pensions Regulator (TPR) recently set out its expectations for current funding valuations

TPR does not typically expect deficit contributions to be reduced or recovery plans extended. Trustees are urged to understand how the pandemic and current economic conditions have affected their scheme’s sponsor

Demonstrating your covenant and cash affordability will be important to ensure company contributions are appropriate for your business plans

Sharing your financial projections, business plans and scenario analyses can help trustees quickly assess affordability and make appropriate informed decisions

Employers could consider offering contingent assets or contingent contributions to reduce cash funding

Employers also need to be aware of new TPR powers and assess the impact of business changes or restructuring activity on their pension scheme

TPR’s expectations depend on the impact of the pandemic on you as employer

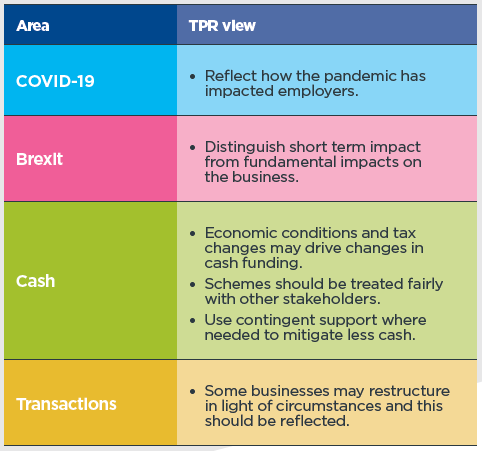

Key covenant areas for current valuations

Actions employers can take

1. Engage early with the trustees and maintain an ongoing dialogue during the valuation process. Share details of corporate transactions as early as is practicably possible.

2. Consider what financial information can be readily shared with the trustees to help them understand the business without the need to undertake significant additional work.

3. Consider what level of contributions are reasonably affordable given your business needs. Document the factors influencing affordability.

4. Investigate whether there are feasible alternatives to cash contributions such as contingent support.

Using covenant analysis to control risk from TPR’s new powers

New moral hazard powers and criminal and civil sanctions are expected to be in force from Autumn 2021. While these are not intended to change commercial norms, a number of companies are reviewing their internal controls to identify and respond to events that may be caught by these powers.

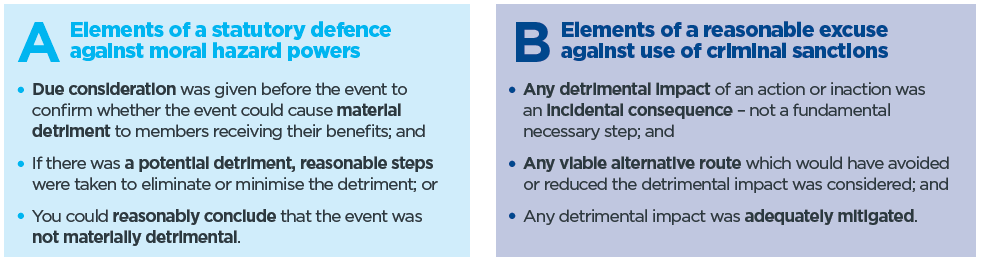

Evaluation: covenant analysis can help build defences against future investigation

Defences are allowed against the new powers. The key components of each defence differ between moral hazard powers and new criminal sanctions. For each, a before and after analysis of the impact on the pension scheme is key – importantly, an analysis of how covenant and employer support has been impacted.

For further information, please get in touch with Paula Haughton or Jim Heal or speak to your usual XPS Pensions contact.

- Register for events

- Join our mailing list

Register for events

We enjoy hosting a wide range of events for pension scheme trustees, corporate sponsors, independent trustees, and pensions professionals.

Join our mailing list

Keep up to date with our latest news and views including pension briefings, XPS insights, reports and event invitations.