Brexit, Biden and Bounceback or Bust?

Brexit, Biden and Bounceback or Bust?

17 Feb 2021

Alasdair Gill, XPS Head of Equity Research, outlines how pension scheme investors can tackle some of the key influences on investment markets in 2021, as the global economy emerges from the shadow of the COVID pandemic. Specifically, he sets out how to tackle the reality of Brexit, the opportunities presented by the new regime in the USA, and the relatively elevated current market levels.

2020 was a year like no other for all of us, as the COVID-19 pandemic took hold. From an investment perspective, perhaps the most surprising outcome was the strong market returns achieved despite the devastating impact of the COVID pandemic on the global economy.

These strong returns were partly driven by unprecedented Central Bank activity, where quantitative easing became turbocharged, and by government giveaways that kept economies moving. Markets have also been keen to price in a vaccine fueled recovery from the pandemic, and this has persisted (to date) despite the serious ‘second wave’ that has been experienced in early 2021.

Brexit impact

So what do Trustees and investors have to grapple with in 2021?

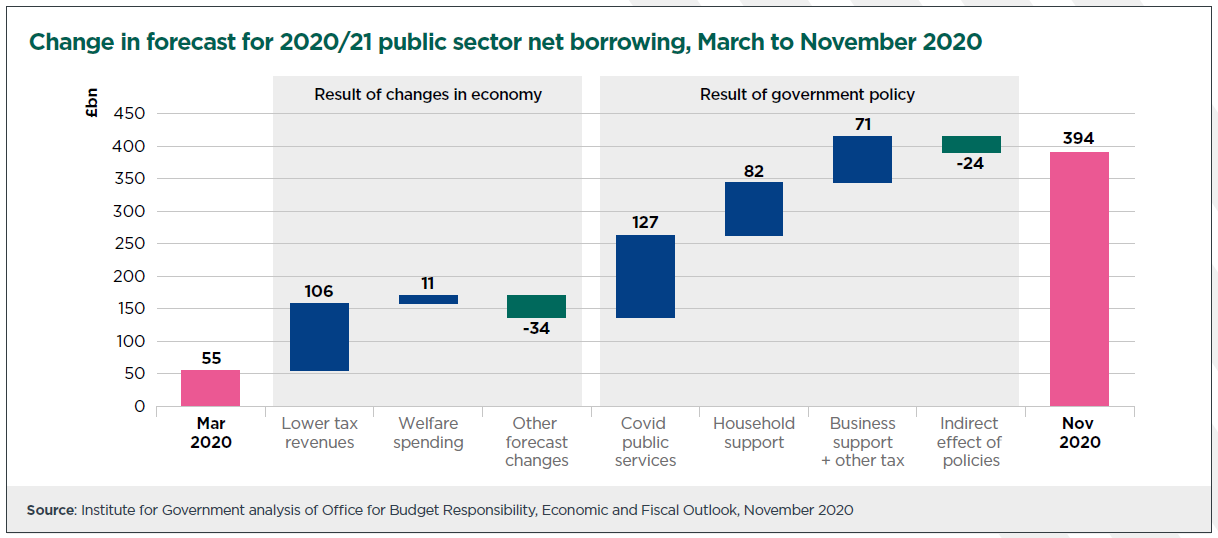

The UK left the EU in January 2020 and finally agreed a Comprehensive Trade Agreement in December 2020. There is debate on the economic impact, which most economists see as negative in the short term. However, for many pension schemes exposed to changes in interest rates and inflation, in the near term the Brexit impact is dwarfed by COVID, which has resulted in a huge rise in government borrowing. The chart below shows the scale of the impact of COVID on the UK public sector borrowing requirement, which is truly unprecedented, and will need to be paid for in future years potentially through higher taxes, which are likely to suppress inflation and economic growth.

The potential impact of Brexit on inflation and Sterling is also up for debate, and only time will tell how material this is for investors – rising UK import costs (and costs of trade via non-tariff barriers) could well put upward pressure on inflation, and a weaker currency could be a contributory factor.

For pension scheme investors, these ‘binary bets’ are, in our view, best controlled carefully by hedging any material inflation and currency risks in their portfolio. We have also long argued that equity portfolios should be more globally focused, and so should not retain too high a UK equity weighting.

President Biden

There is no doubt that the inauguration of President Biden will see a material change in direction in economic policies in the USA.

Unsurprisingly, the $1.9trn economic stimulus to counter the impact of the pandemic and acceleration of the vaccination programme are top of his agenda, but noticeably Climate was cited as his next priority. Indeed, one of Biden’s first executive orders was to re-join the Paris Climate Accord. Additionally, the next UN Climate Change Summit (COP26) is to be held in Glasgow in November (postponed from 2020). Although in 2020 the World enjoyed a COVID inspired 7% reduction on annual carbon emissions, the year was also the hottest on record. The introduction of new climate reporting regulations due to come in from October 2021 for larger Schemes in the UK will make Climate Change an increasing focus for Trustees.

For example, another of Biden’s ‘day one’ executive orders was to cancel the permit for the Keystone XL pipeline from Canada to the US. This pipeline was due to pump Oil Sands (a particularly environmentally damaging fossil fuel) from Canada to the Gulf coast and has long been a source of controversy since it was originally proposed in 2008. This is another clear sign of policy direction, and shows that the USA is now taking material steps to decarbonise their economy.

We continue to believe that a focus on sustainable investing is likely to reduce risk and potentially improve portfolio returns, and we have been busy researching different practical ways for investors to implement more sustainable investment policies.

We believe that sustainable investing should be a key focus for Trustees in 2021, and you will hear more from XPS on this topic in the year ahead.

Bounceback or Bust?

Finally, to the economy and markets. Equity markets (with the exception of the UK) enjoyed a surprisingly strong 2020, and despite the large falls at the onset of the pandemic, global equities returned 13% in 2020 (see chart below).

January also started positively, but faltered towards the end of the month with many commentators suggesting that, with the S&P now trading with a Price/Earnings of nearly 30, markets are destined for a pull back.

Others highlight the pent-up demand for consumption that will be unleashed when lockdown conditions ease, and predict a strong economic recovery, and with low interest rates seemingly here to stay for the medium term, investment managers with a more optimistic view believe that this justifies the current high equity market rating.

However, recent chatroom based collusion to bid up ‘shorted’ shares, (see Simeon Willis’s article here) and tales of retail investors making millions do start to sound like headlines from a late stage bull market. There are certainly some areas of the market where valuations appear seriously stretched (see Nasdaq 100 index long term chart below).

XPS does not make short term market predictions, however for schemes with equity exposure in their portfolios, we do believe that Trustees should check that they can ‘afford’ a short term material (20%-30%) fall in equites by assessing the impact of such a scenario on their portfolio.

Summary

Pension scheme investors will have another busy agenda in 2021, with the key challenge of achieving the returns and income they need in the continued low interest rate environment, with key equity markets highly valued by historical standards.

We believe that investors should be vigilant in managing inflation, interest rates and current risks in their portfolio, and these risks should be re-assessed in the light of Brexit. Current market levels point towards caution and the need for scenario testing against a range of possibilities such as an equity market downturn.

One final key action we believe can both help returns and manage risk (particularly climate risk) is to position your growth portfolio to benefit from the transition to a low carbon economy.

To discuss any of the issues covered in this edition, please get in touch with Alasdair Gill, Simeon Willis or your usual XPS contact.

- Register for events

- Join our mailing list

Register for events

We enjoy hosting a wide range of events for pension scheme trustees, corporate sponsors, independent trustees, and pensions professionals.

Join our mailing list

Keep up to date with our latest news and views including pension briefings, XPS insights, reports and event invitations.