2021 outlook for pension scheme trustees and employers

2021 outlook for pension scheme trustees and employers

21 Jan 2021

What you need to know

- 2020 was an unprecedented year. Not only did schemes have to manage the impact of the pandemic; Brexit preparations and negotiations continued to dominate both the economic and political agenda, with a trade deal finally being agreed at the eleventh hour of 2020.

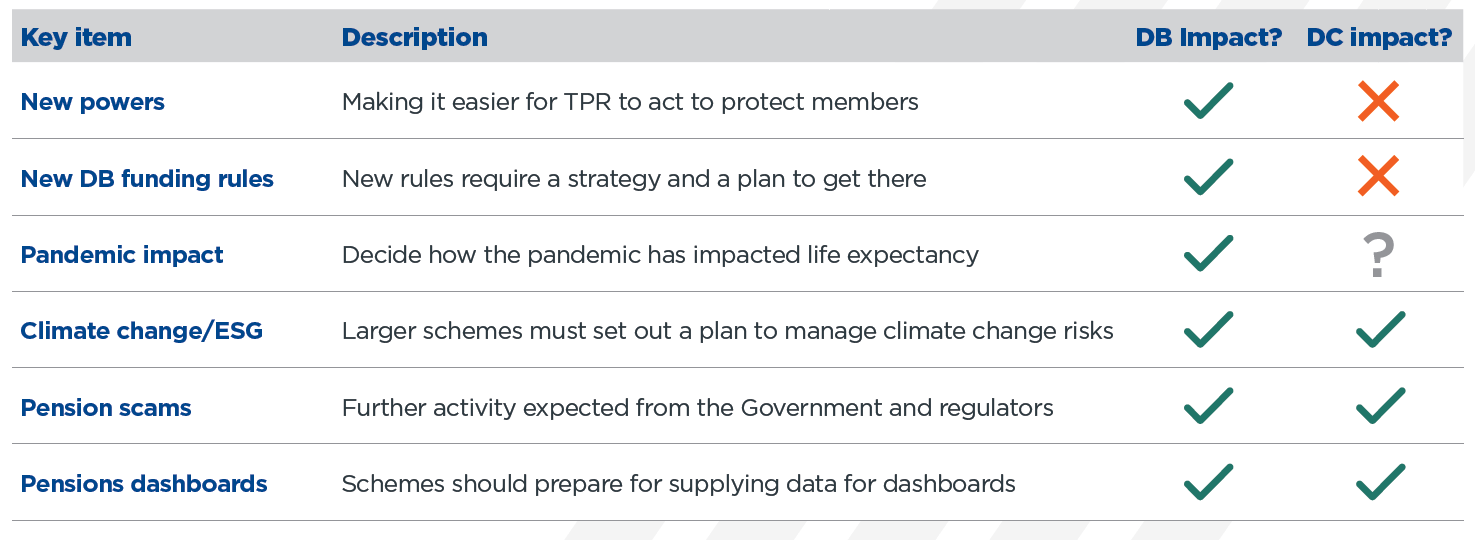

- 2021 looks to be just as busy for pension schemes, but hopefully more predictable. The Pension Schemes Bill has almost completed its lengthy passage through Parliament, and is expected to receive Royal Assent imminently. It will introduce several major changes to pensions law impacting both defined benefit (DB) and defined contribution (DC) schemes.

- Changes being introduced include tougher powers for The Pensions Regulator (TPR), new criminal sanctions for wrongdoing, changes to the funding regime for DB schemes, stricter rules on DB pension transfers, new requirements on climate change risk reporting and a legislative framework to support pensions dashboards.

- We expect to start feeling the impact of the Pension Schemes Bill during 2021, but more is on the horizon. In this Insights, we set out our thoughts on this and other issues which are likely to affect the pensions industry in 2021.

Actions you can take

- Ensure you incorporate upcoming developments into agendas and activity plans.

- Watch out for regulations providing details of the Pension Schemes Bill’s measures.

- Be aware of TPR’s upcoming new powers and sanctions in any corporate activity.

- Decide how to reflect the impact of the pandemic in expectations of life expectancy.

- Act on developing Government and regulatory activity to protect members from pension scams.

- Plan for the future need to supply data for use in dashboards.

Key expected developments in 2021

The finer detail: Key developments in more detail

Stronger regulatory powers

The Pension Schemes Bill will significantly strengthen TPR’s powers, increasing its oversight of corporate transactions, providing new grounds for issuing contribution notices and introducing new criminal and civil sanctions. With much of the detail to be set out in regulations and guidance, trustees and sponsors will need to watch closely.

Scheme funding rules

Consultation on the new DB funding code of practice is expected in the second half of 2021, and will include the full response to the first consultation. In the meantime, trustees should consider how the requirement to set a long-term funding objective and investment strategy may impact their scheme.

GMP equalisation

The November 2020 judgment on the need to revisit historic transfer value payments provided a further missing piece in the GMP equalisation jigsaw. Whilst trustees should now have a clearer idea of how to proceed and be finalising their equalisation strategy, the need to revisit transfers paid out since 17 May 1990 will present significant challenges.

Impact of the pandemic on life expectancy

Trustees and employers will need to reflect both the immediate and long-term impact of the pandemic in life expectancy assumptions. The Continuous Mortality Investigation will provide tools to adjust but not say by how much.

Economic recovery and Brexit

Although the full economic impact of COVID-19 and Brexit will not be known for many years, 2021 is likely to see a growing number of stressed employers. Trustees will need to carefully monitor their investment strategy and employer covenant.

Pension scams

The Government and regulators are likely to increase their response to pension scams. Trustees will need to assess if their scheme is following best practice to protect members.

Climate change/ESG

Environmental, social and governance (ESG) issues climbed the political agenda in 2020. From October 2021, trustees of the largest schemes will have new climate risk reporting duties, with possible extension to smaller schemes due to be reviewed in 2024.

DB superfunds

TPR put in place interim regulatory guidance for assessing and supervising DB superfunds in 2020, with further guidance expected in 2021. Once the first superfund transactions occur, this could lead to growth in the market. As such, trustees can consider including superfunds as possible end-game options when setting strategy and journey plans.

DC consolidation

With continuing regulatory pressure on DC schemes to improve member outcomes, and new reporting requirements due to take effect from October 2021, the trend in DC schemes transferring to master trusts is set to continue.

Pensions dashboards

The Pension Schemes Bill provides the legislative framework to compel pension schemes to supply members’ data for use in dashboards. Although staged participation is likely from 2023, trustees should start to prepare their scheme’s data to ensure it is ready.

Single code of practice

TPR’s new single code of practice is due to take effect in 2021 (following consultation). This is likely to put greater focus on risk management processes, so governance will need to remain at the top of trustees’ agendas.

Annual benefit statements

The Government is due to consult on mandating the use of simpler annual benefit statement templates for DC auto-enrolment schemes, as well the timing of issuing statements.

For further information, please get in touch with Caroline Ekins or speak to your usual XPS contact.

- Register for events

- Join our mailing list

Register for events

We enjoy hosting a wide range of events for pension scheme trustees, corporate sponsors, independent trustees, and pensions professionals.

Join our mailing list

Keep up to date with our latest news and views including pension briefings, XPS insights, reports and event invitations.